The Tax Suite

With workflow tools, tax organizers, KBA e-signatures, and file storage — Double has everything you need to manage your tax clients.

Get started

Trusted by thousands of bookkeepers and accountants

Introducing... The Tax Suite!

Bring every part of your tax workflow into one system. From intuitive organizers to KBA e-signatures, Double's Tax Suite streamlines the prep process so your team can file faster, with less back and forth.

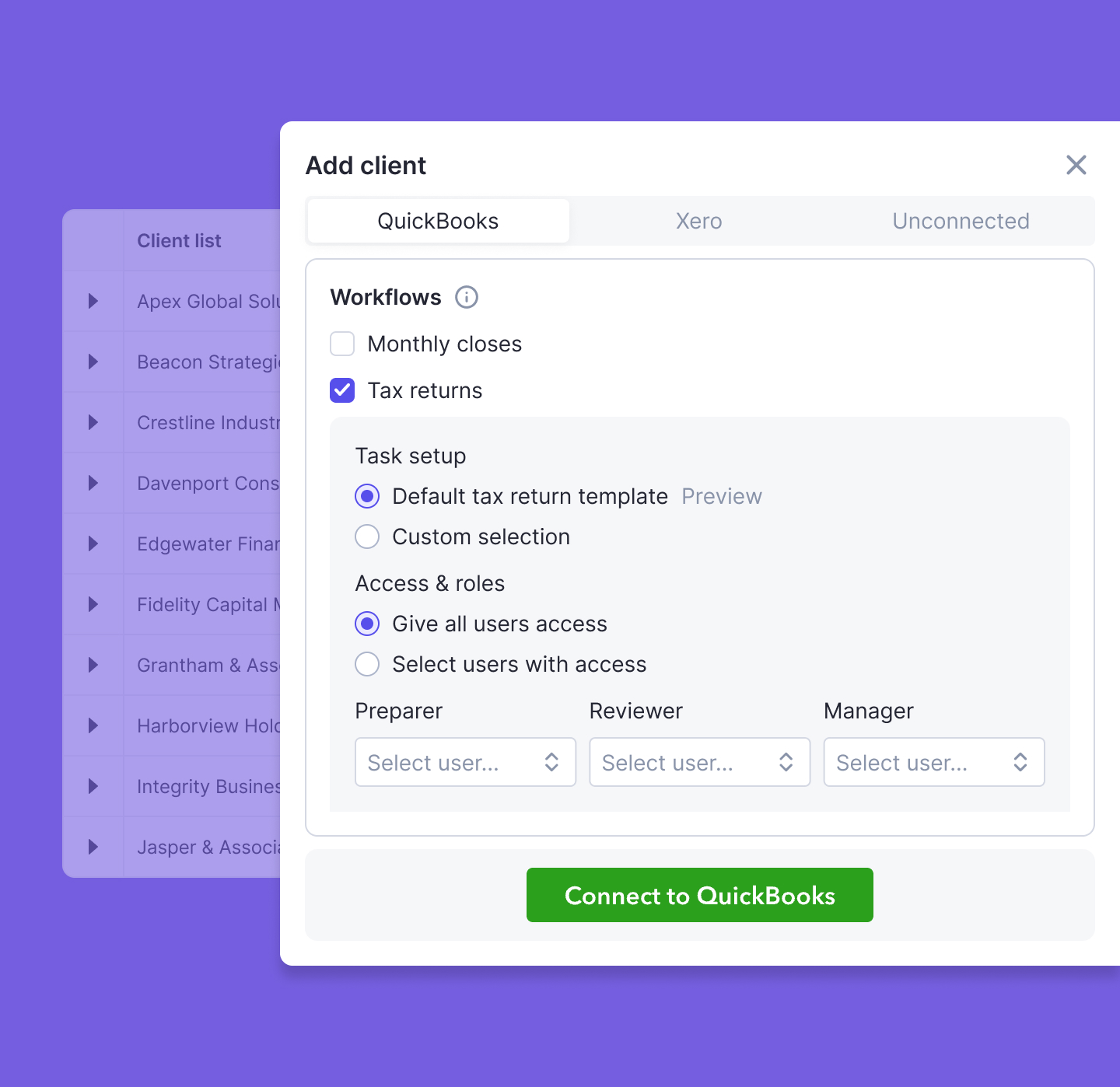

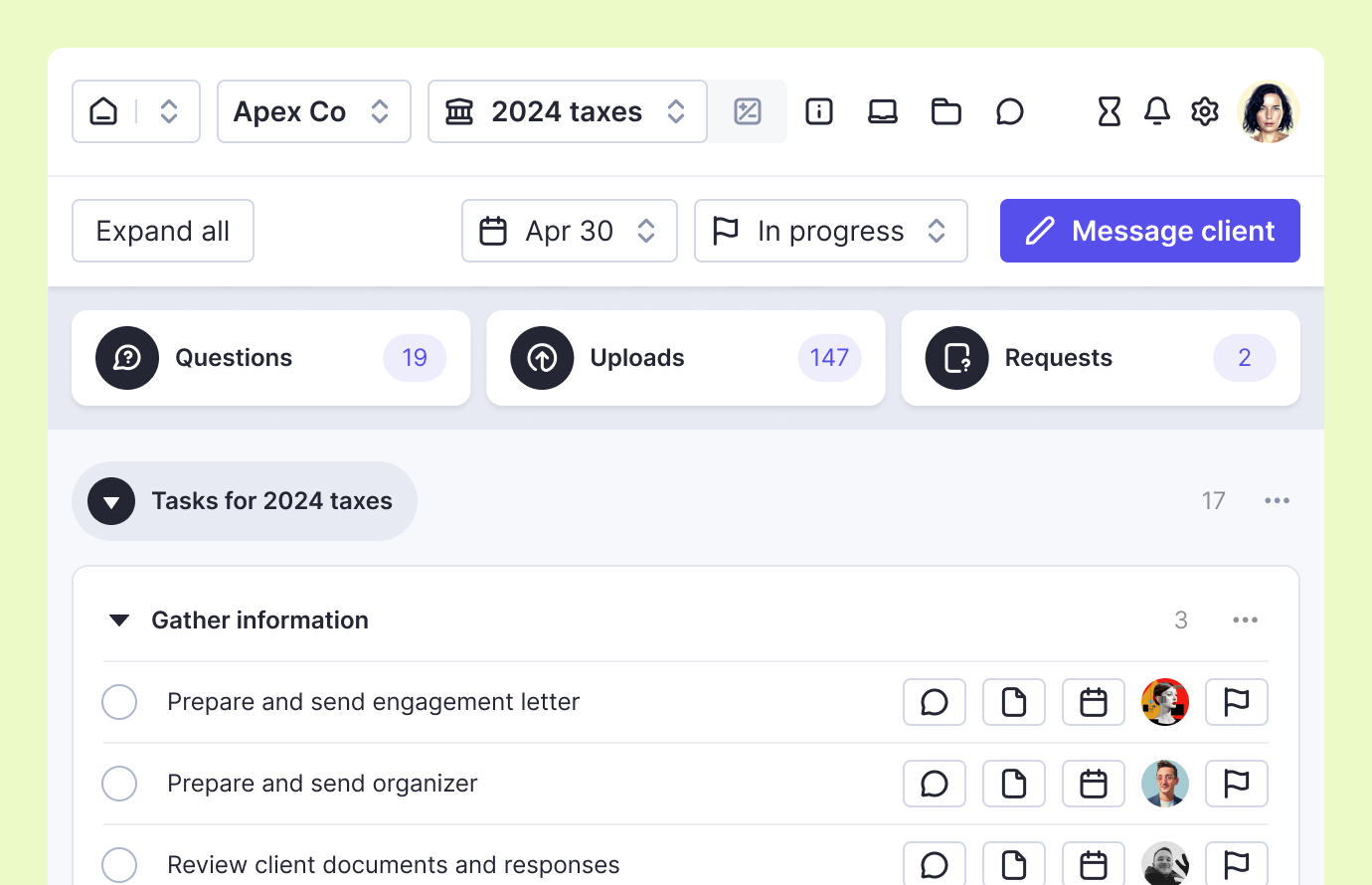

Organize tax-related tasks

Standardize your prep process across all clients. Double's workflows give you a full view of task completion and status updates, so you can stop asking “who’s working on what?” and start filing returns faster.

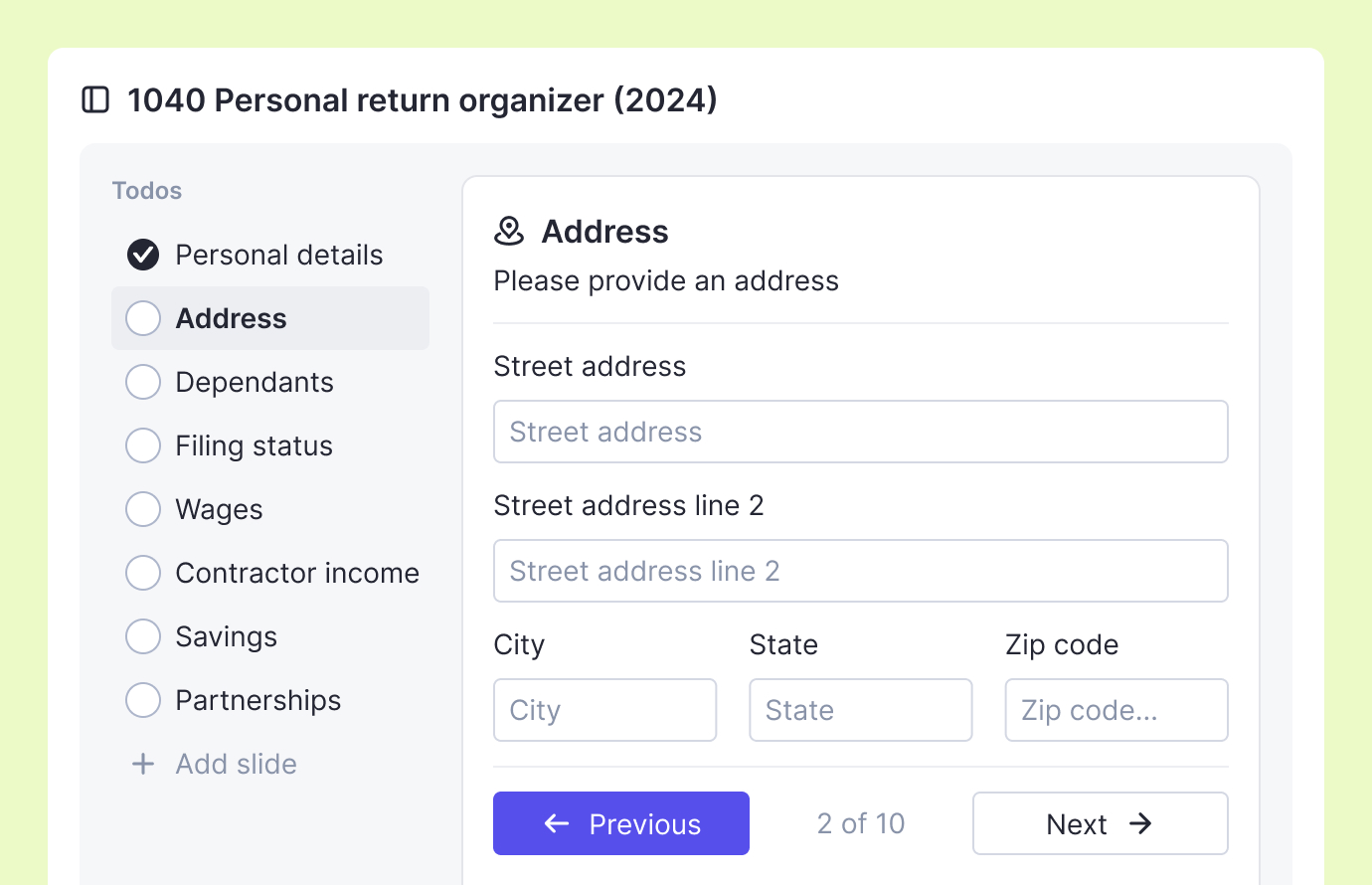

Give your clients an intuitive tax organizer

Gather all the information you need by publishing an interactive form with a single click. Use Double's default 1040 Organizer, customize it, or create your own from scratch. Clients can respond by logging into their Client Portal, or on the go using Double's Mobile App.

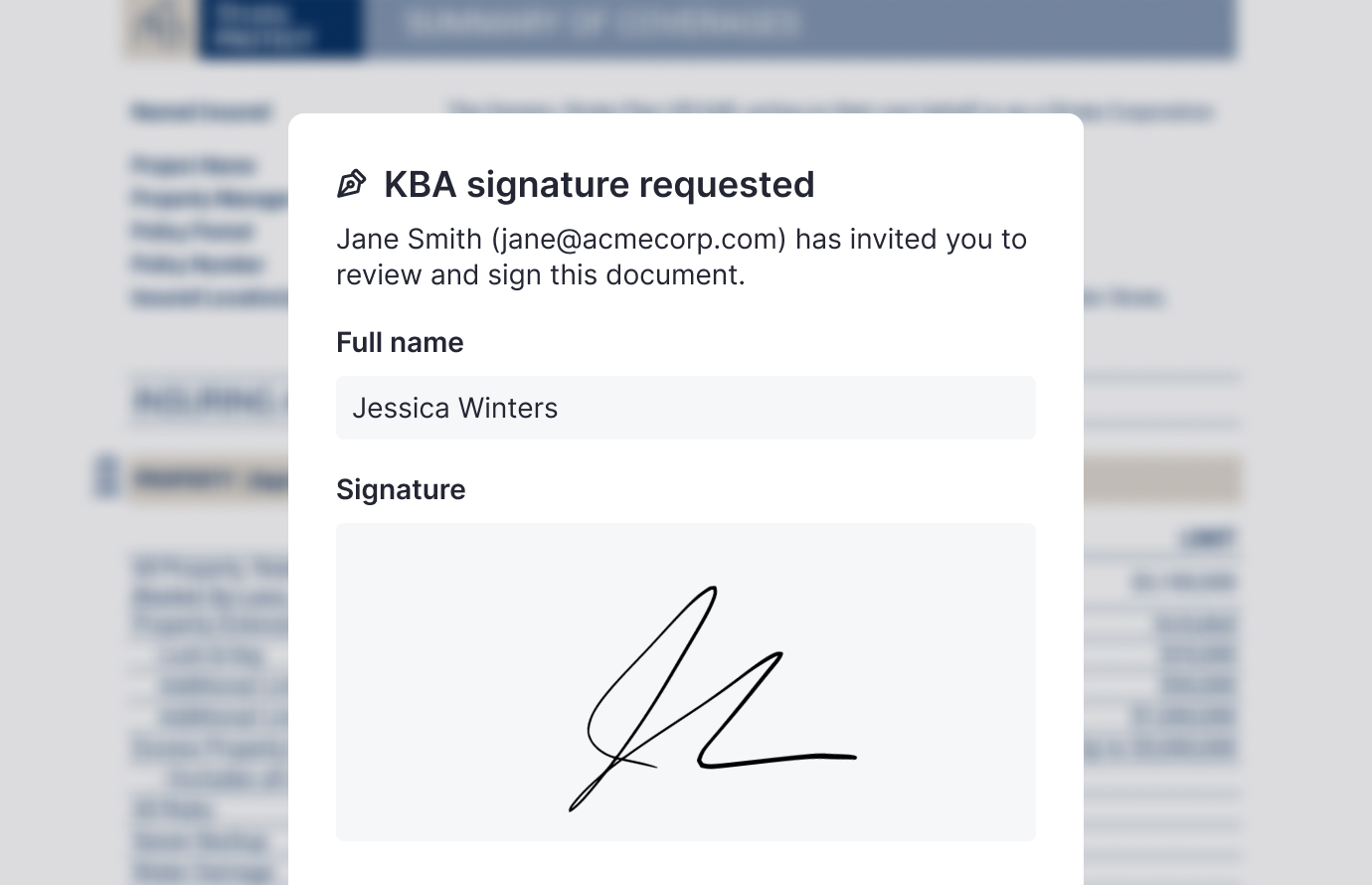

Send KBA e-signature requests

Securely collect IRS-compliant e-signatures for Form 8879 and beyond. Add templates, set signing order, and verify signer identity through knowledge-based authentication—without leaving Double.

Share updates in real time

You know what's better than a live tracker for pizza deliveries?

A live tax tracker that helps cut down on "what's the status of my return?" emails.

Within the Client Portal, clients can easily view the progress of their tax returns, as well as any descriptions of the specific work being completed.

A live tax tracker that helps cut down on "what's the status of my return?" emails.

Within the Client Portal, clients can easily view the progress of their tax returns, as well as any descriptions of the specific work being completed.

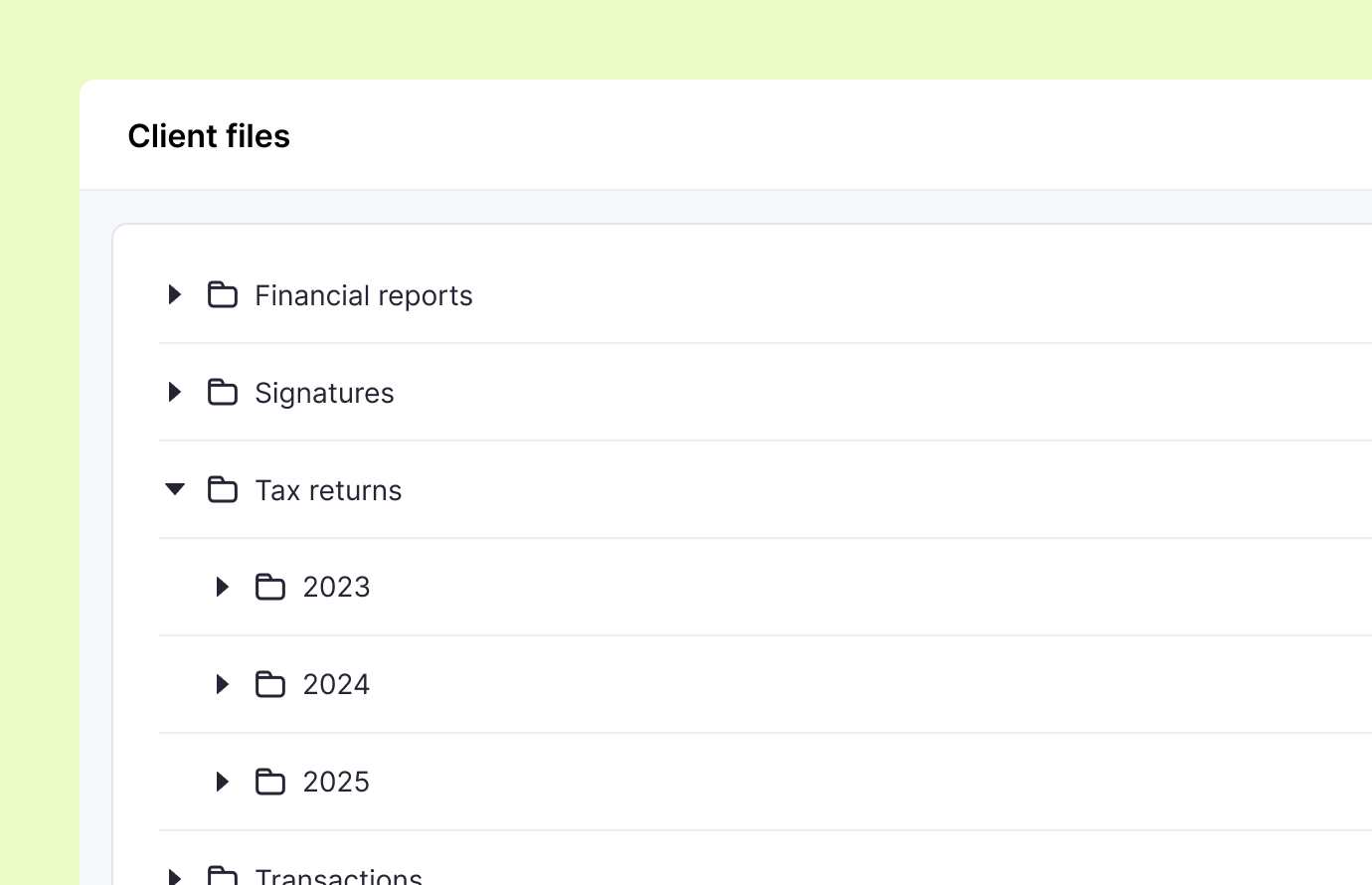

Store and organize every file

Cut down on administrative headaches—all client documents, signatures, and return files are automatically stored in the app and sorted by year. Your team and your clients will always know where to find what they need.